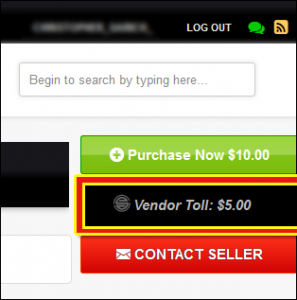

Vendor-Toll or Not & what is a Vendor-Toll Anyway?

Vendor-Toll: ‘The total cost for out of pocket expenses. Example: Travel Expenses; or Costs which may incur a fee for outside the normal usage such as excess bandwidth charges” “It’s like a Shipping Cost” @10 functions at an international level with the facility to service your skill specifically to a set ‘Geographical location’, for this reason we have introduced Vendor-Toll. It’s a fee which the vendor “Seller” charges an additional fee ontop of the skill posed to cover additional expenses otherwise known as ‘unknown extras’ to the buyer which can become sticky when when offering the deal. These ‘extras’ have a variable tally amount, thus the Vendor toll concept has been introduced to compensate for any resource consuming extras such as but not limited to: “Shipping Charges; freight costs; potential additional ISP bandwidth related Charges when sending over-sized files. We feel best of all members who wish to serve within their local community can receive benefits for travel related expenses. In some cases a member who service high volume clients may be obligated to on-pass tax. Very Important: Government charges such as VAT or Carbon Tax can also be considered as a Vendor Toll Charge. Be sure you mention what the Vendor Toll is for if you are to add this cost into your skill post, and remember only to charge a Vendor Toll if that’s what you incur, Otherwise its more than likely just a matter of time before the critics find out.

@10 Value’s you’re feedback regarding Vendor-Toll

Note to Australian based members: Gst. Should not considered as a Vendor Toll surcharge.

Thank you for your time to take note.

Team@10Bucks